Client letters:

2017 Tax Preparation

As the end of the year approaches, it is a good time to think of planning moves that will help lower your tax bill for this year and possibly the next.

2017 Year End Tax Planning Tips

- If you are required to take required minimum distributions (RMD) for 2017 from your retirement accounts, make sure that you fulfilled your requirement by year end. RMD is required if you are over 70 ½. Consider a direct contribution of RMD amount to a charity to fulfil your charitable goals.

- If you have investments with an unrealized loss, consider whether you should realize those losses by selling the investments before the end of the year. If you like the stock and want to buy it back, be aware of the wash sale rules, which is 30 days before and after the sale.

- To the extent you can control the timing of your medical expenses, group them into the same tax year so they will exceed the yearly threshold to deduct them. The threshold is 10% of your AGI for those under 65; 7.5% for those above 65.

- Be sure to check your flexible spending account balance. Depending on your flexible spending account you may be allowed to carry over $500 to the next year.

- If you are thinking about making gifts to charities, consider appreciated securities. If you are unsure which charities to give yet, or won't be itemizing next year, but want the tax deduction this year, consider a donor advised fund (DAF).

- If you paid household employees $2,000 or more, remember the payroll tax filings are due by January 31, 2018.

- The annual gift exclusion amount for 2017 is $14,000 per person; it's increased to $15,000 for 2018.

- Prepay your state taxes. Both the Senate and house bills of the Jobs Act eliminate state income and sales tax and only allows for $10,000 of property tax. Considering prepaying your income taxes (making your 4th quarter installment in December of 2017) and prepaying your real estate tax now and defer only $10,000 if you think AMT tax is a concern for 2018.

For more tax planning tips and recent tax updates, please visit our website at www.bolsoncpa.com or contact us.

Tax Cuts and Jobs Act (the Act)

Foremost on everyone's mind is the tax reform. The House passed its bill on November 16, the Senate passed its version on December 2. Congress is beginning its process of reconciling the two similar and yet significantly different tax reform bills through a conference committee where both bills will be examined by chosen lawmakers and then crafted into one unified measure called "conference report". It's expected that the final bill will more closely resemble the Senate's version because of its budgetary rules. We don't know when the final bill will be ready, it could be end of this year, it could be early 2018. Most of the provisions will take effect in 2018.

Some key changes for individuals are:

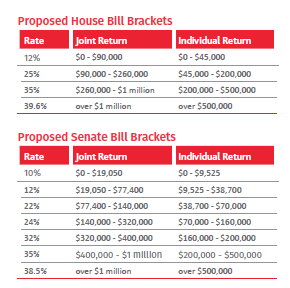

New tax brackets & break points, see below for an illustration for joint and individual filers.

Increased Standard Deduction & Elimination of Personal Exemptions

Basic standard deduction increased. The Act would increase the standard deduction to $24,000 for married individuals filing a joint return, $18,000 for head-of-household filers, and $12,000 for all other taxpayers. The Act would not make any changes to the current-law additional standard deduction for the elderly and blind. Personal exemptions suspended. The Act would effectively repeal the deduction for personal exemptions (which under current law is scheduled to be $4,150 for 2018, subject to a phase out for higher earners) by reducing the exemption amount to zero. New Deduction for Pass-Through Income

New 23% deduction. The Act would generally allow a non-corporate taxpayer who has qualified business income (QBI) from a partnership, S corporation, or sole proprietorship to deduct the lesser of:

- The "combined qualified business income amount" of the taxpayer, or

- 23% of the excess, if any, of the taxable income of the taxpayer for the tax year less net capital gain.

State and Local Tax Deductions

State and local income or sales tax deduction. The deduction would be suspended for individuals.

Property tax deduction. The Act would limit the amount of the property tax deduction to $10,000 for married taxpayers ($5,000 for individuals).

Medical Expense Deduction

Deduction for medical expenses. The Act would reduce the floor on medical expense deductions to 7.5% (down from 10% under current law) for all taxpayers for tax years beginning after Dec. 31, 2016 and ending before Jan. 1, 2019.

Sale of Principal Residence

Gain from sale of principal residence. The Act would require that, in order to exclude gain from the sale of a principal residence under Code Sec. 121 (up to $500,000 for joint filers; $250,000 for others), a taxpayer would have to own and use as a home the residence for five out of the previous eight years (as opposed to two out of five years under current law), effective for sales and exchanges after Dec. 31, 2017.

Estate and Gift Taxes

E&G exemption amount. The Act would double the base estate and gift tax exemption amount—i.e., the amount of transferred property that is exempt from estate and gift tax—from $5 million (as indexed for inflation; $5.6 million for 2018) to $10 million (which will also be indexed for inflation). Thus, the basic exemption amount would be approximately $11 million for individuals and $22 million for couples for 2018.

Alternative Minimum Tax

AMT exemption amounts increased. The Act would increase the AMT exemption amounts for individuals as follows:

- For joint returns and surviving spouses, from $78,750 under current law as adjusted for inflation ($86,200 for 2018) to $109,400, as adjusted for inflation in tax years beginning after 2018.

- For single taxpayers, from $50,600 under current law as adjusted for inflation ($55,400 for 2018) to $70,300, as adjusted for inflation in tax years beginning after 2018.

Interest on home equity indebtedness

Deductions on interest on home equity loans will be suspended; no change on deduction for interest on acquisition indebtedness.

Carried Interest

Holding period requirement — carried interest. The Act would impose a 3-year holding period requirement in order for certain partnership interests received in connection with the performance of services to be taxed as long-term capital gain rather than ordinary income.

Increased Child Tax Credit

Increased child tax credit. The Act would increase the child tax credit to $2,000 (from $1,000 under current law).

Increased age limitation. The Act would increase the age limit for a qualifying child by one year such that a taxpayer would be able to claim the credit with respect to any qualifying child under 18 (but only for tax years beginning after Dec. 31, 2017 and before Jan. 1, 2025).

Non-child dependent credit. The Act would also provide a $500 nonrefundable credit for non-child dependents.

Getting Ready for Taxes

We want to make tax filings easy for you. We have developed the schedule below for you to use so the return preparation process can be efficient and effective.

| January 13, 2018 |

If you would like to meet between February 1 and March 9, please contact Dana, or request your appointment from our website. A meeting is not required for us to prepare your return. |

| January 22, 2018 |

Organizers and engagement letters in PDF are uploaded to your portal for you to access. Please use the tax organizers to minimize errors caused by omitted data. Please print the engagement letters, review and sign them and send to us with your tax data. If you like them mailed to you, please contact Dana. If you requested them mailed for 2016, we will continue to do so. No need to call again. |

| February 1 - March 9, 2018 |

Tax information meetings for those of you that would like to meet in person; encouraged for new clients. You are not required to have all of your data at time of the meeting. You are not required to meet in order for us to prepare your return. Other ways to get us your tax data is by uploading your data to the portal, faxing, emailing, mailing or dropping-off. |

| March 15, 2018 |

We must have the bulk of your tax data in order to prepare your tax return for filing by April 16, 2018. |

| April 2, 2018 |

We need your final open items, such as missing K-1s, to complete your return by April 16, 2018. This is also the deadline for you to provide us data if you want us to calculate extension payment(s). |

| April 16, 2018 |

Taxes must be paid, and returns or extensions filed; first 2018 estimated tax payment is due. |

| June 15, 2018 |

Your second 2018 estimated tax payment is due. |

| September 15, 2018 |

Your third 2018 estimated tax payment is due; if you are on extension, we need every last bit of your tax data! |

| October 15, 2018 |

Extended tax returns are due. |

We do our best to work on tax returns whenever we receive your data, but we may not be able to complete returns by IRS deadlines when the data is submitted late. Our turnaround time for completion is 2–3 weeks. The turnaround for tax data received from late February on is typically about 3-4 weeks, therefore, please plan ahead.

We Appreciate Referrals

Your referrals have enabled our firm to grow. We appreciate your trust and confidence in us and will take good care of everyone you send us. As a token of our appreciation, we will send you a $25 gift card for each person that you refer to us that has become a client.

Privacy

We respect your privacy. The personal, non-public information we collect about you has been derived from information that you have provided to us directly or indirectly and from transactions with us. We do not disclose personal information about you to anyone outside our firm, except at your specific request, as required by law, or to our software vendors in resolving an IT issue.

|